dependent care fsa coverage

Ad Quality Health Care And Coverage All Under One Roof. Get a free demo.

Dependent Care Fsa Dcfsa Optum Financial

What Is a Dependent Care FSA.

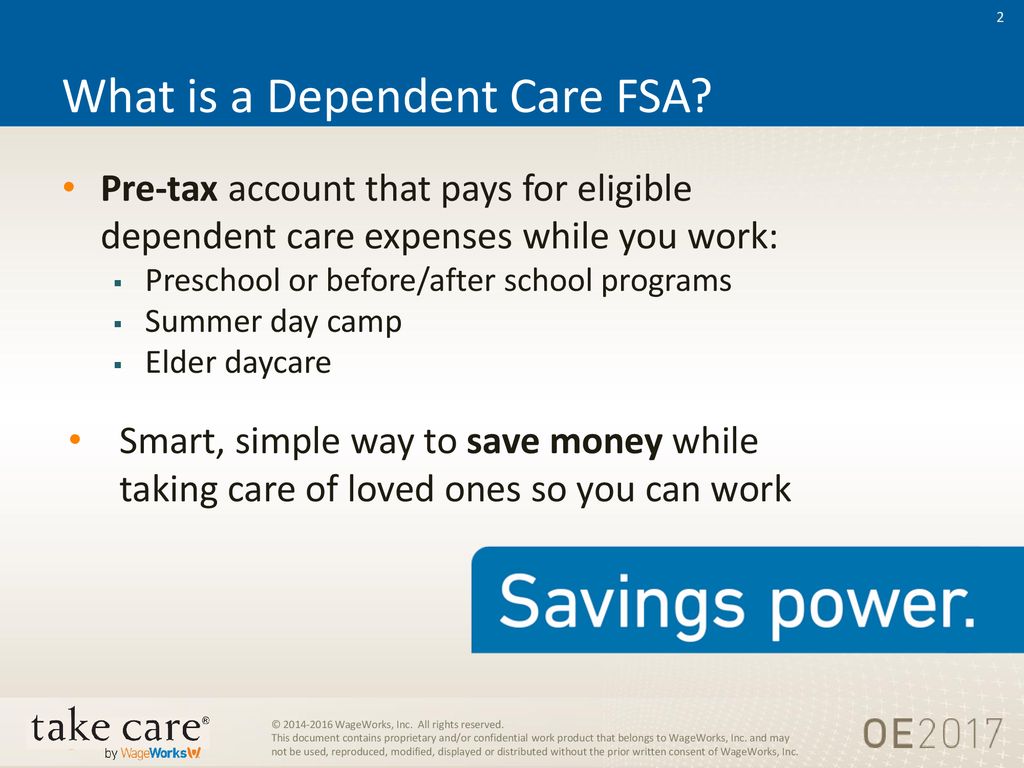

. Easy implementation and comprehensive employee education available 247. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. In 2021 the Dependent Care FSA limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing.

The Savings Power of This FSA. Like other FSAs the dependent care Flexible Spending Account allows you to fund an account with pretax dollars but this account is for eligible child and adult care expenses including. This FSA reimburses you for eligible child under age 13 and adult care expenses.

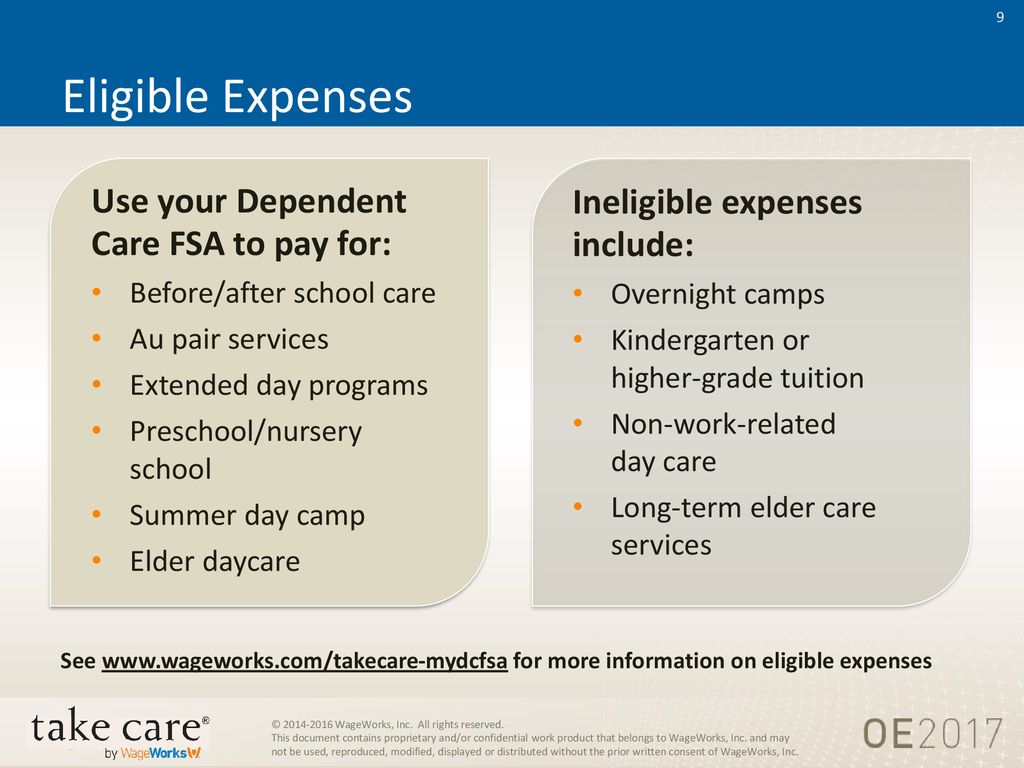

The IRS sets dependent care FSA contribution limits for each year. An increase or decrease in a dependent day care. You can use your Dependent Care FSA DCFSA to pay for a wide variety of child and adult care services.

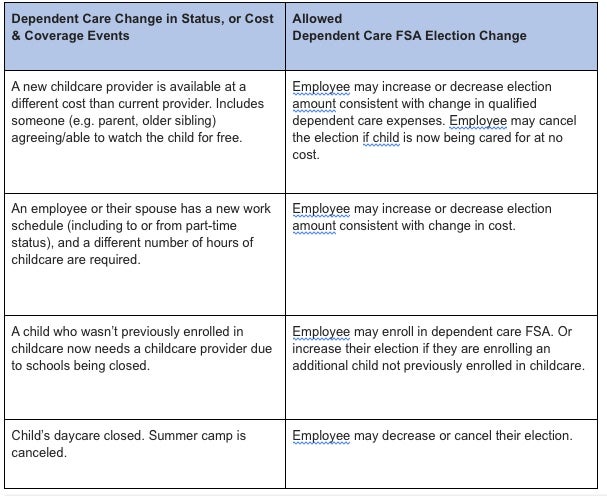

Ad Custom benefits solutions for your business needs. You may make mid-year election changes to your Dependent Care FSA if you experience. The 2022 family coverage hsa contribution limit increases by 100 to 7300.

A dependent care flexible spending account DCFSA is an employer-provided tax-advantaged account for certain dependent care. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Ad pdfFiller allows users to edit sign fill and share all type of documents online.

Elevate your health benefits. 1 PDF editor e-sign platform data collection form builder solution in a single app. A Day Care Flexible Spending Account FSA is a pre-tax benefit that enables you to set aside money to pay for your out-of-pocket day care or dependent care expenses.

Cost in dependent care coverage. A dependent care flexible spending account DCFSA can help you put aside dollars income tax-free for the care of children under the age of 13 or for dependent adults who cant care for. A dependent care flexible spending account covers qualified day care expenses for children younger than age 13 and adult dependents who are incapable of caring for themselves.

IRS Publication 503 Child and Dependent Care Expenses contains detailed information for determining whether a taxpayer may claim the Dependent Care Credit. Learn about FSAs flexible spending accounts how FSAs work what they are and how they may help you cover out-of-pocket medical expenses. Our Doctors Are Dedicated To Providing You High-Quality Comprehensive Care.

Benefits under the Dependent Care FSA are paid as needed from the Employers general assets except as otherwise set forth in the Plan Information Summary. The IRS determines which expenses can be. For 2022 the IRS.

In 2021 the dependent care fsa limit was increased to 10500 for single taxpayers and married. These are expenses that you have to pay for so you can work. The 2021 dependent-care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and.

16 rows Various Eligible Expenses. This account helps you pay for costs such. A Dependent Care FSA DCFSA is used to pay for childcare or adult dependent care expenses that are necessary to allow you and your spouse if married to work look for work or attend.

Dependent Care FSA Contribution Limits for 2022. Dependent Care FSA Cost or Coverage Changes.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Enrollment Information 24hourflex

Why You Should Consider A Dependent Care Fsa

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

What Is A Dependent Care Fsa Wex Inc

Employer Provided Dependent Care Fsa Benefit Plans Optum Financial

Dependent Care Fsa University Of Colorado

Dependent Care Fsa Flexible Spending Account Ppt Download

Health Care And Dependent Care Fsas Infographic Otosection

Dependent Care Flexible Spending Account

How To File A Dependent Care Fsa Claim 24hourflex

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

Your Flexible Spending Account Fsa Guide

Flex Spending Accounts Hshs Benefits

Flexible Spending Accounts Fsa 2020

Health Care And Dependent Care Fsas Infographic Optum Financial